The coronavirus pandemic has hit globally in almost every sector, especially the economic sector. Many Australian are getting less pay, working fewer hours, and working from home. It might be scary for many people to manage their budget for expenses while finding themselves strapped for cash.

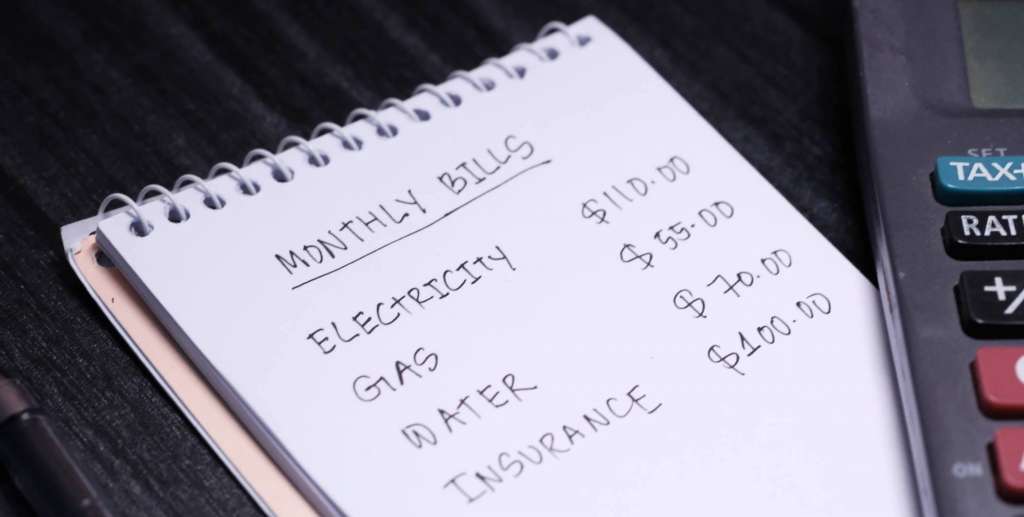

Using money wisely is the best thing to do during this pandemic, but there are some expenses that you can’t avoid like utility bills, phone bills, credit card bills, etc. While you are managing your budget, uncertain things like medical emergency, car breakage, and pipe leakage can ruin your financial planning.

If you’re struggling financially and need some quick cash for emergencies, you can always rely on Spondooli for a fast cash loan of up to $5000.

A fast cash loan is a type of loan that you can get within a few hours. Using a simple online application process, once approved the funds are directly deposited into your bank account.

Here are some of the reasons why fast cash loans can help you during this pandemic.

Easy To Access

The best thing about the fast cash loan is it’s easy to access. During this coronavirus (COVID-19) outbreak, you don’t need to visit the lender personally. Everything is done online within a few minutes; all you need is to visit the lender’s website, fill a form, and submit the application.

If approved, the amount will be deposited into your bank account within a few hours or instantly using your Payer ID.

Fewer Requirements

Remember the bank loans and all those documents? Fast cash loans are entirely different; you won’t need all the documents to apply for a loan. If you are an Australian citizen, are employed and can demonstrate proof of your income, you are eligible to apply for a fast cash loan.

Generally, for a fast cash loan you will need:

- Be employed and earn $700 or more a week

- A current drivers license

- Last 90 days bank transaction history

- 2 x current Payslips

Can Apply Even With Bad Credit

There are other loans where credit scores are a crucial factor in deciding the approval of the loan. However, with a fast cash loan your credit score has nothing to do with it. Even if your credit history is not good, you can apply and get the loan.

They are designed to help people who need money in emergencies.

Flexible Payments

The major concern about the people while taking a loan is what happens if we failed to pay the loan in time? Don’t worry; everyone knows that things don’t happen as we planned.

If you feel like you can’t make the payment in time, contact the lender before the due date, and explain your situation. They will adjust the payments according to needs and ability to pay. The main aim of a fast cash loan is to help you during an emergency, not to make things worse.

Fast cash loans have lots of benefits, but before you apply for the loan, you need to consider a few things, such as whether you will be able to pay the loan back, research the lender, and how fast they have approved loans in the past. For a fast, secure, and easy loan, Spondooli is the perfect lender for you. Even if you do a budget, with fewer hours and less pay sometimes you can’t budget for emergencies, and Spondooli fast cash loans are an easy and fast solution.